Business Expenses For Self Employed 2024 – Taxation rules for payroll are fairly straightforward, but reimbursed business expenses for mileage and other expenses are not treated the same as income by the Internal Revenue Service. . Learn what expenses are deductible. As a self-employed person, you can deduct expenses for your office even if your office is in your home. Calculate the amount of home space devoted to your .

Business Expenses For Self Employed 2024

Source : www.amazon.comSelf Employed Tax Deductions Calculator 2023 2024 Intuit

Source : blog.turbotax.intuit.comMileage Log book 2024: For Self Employed, Journal Tracker For Car

Source : www.amazon.comPDF] Tax Year Diary 2023–2024: Tax Year Diary for Self Employed

Source : medium.comAmazon.com: Tax Year Diary 2023 2024 | Cute Panda Hanging On

Source : www.amazon.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.com2024 Mileage log book for taxes for self employed: Car Tracker for

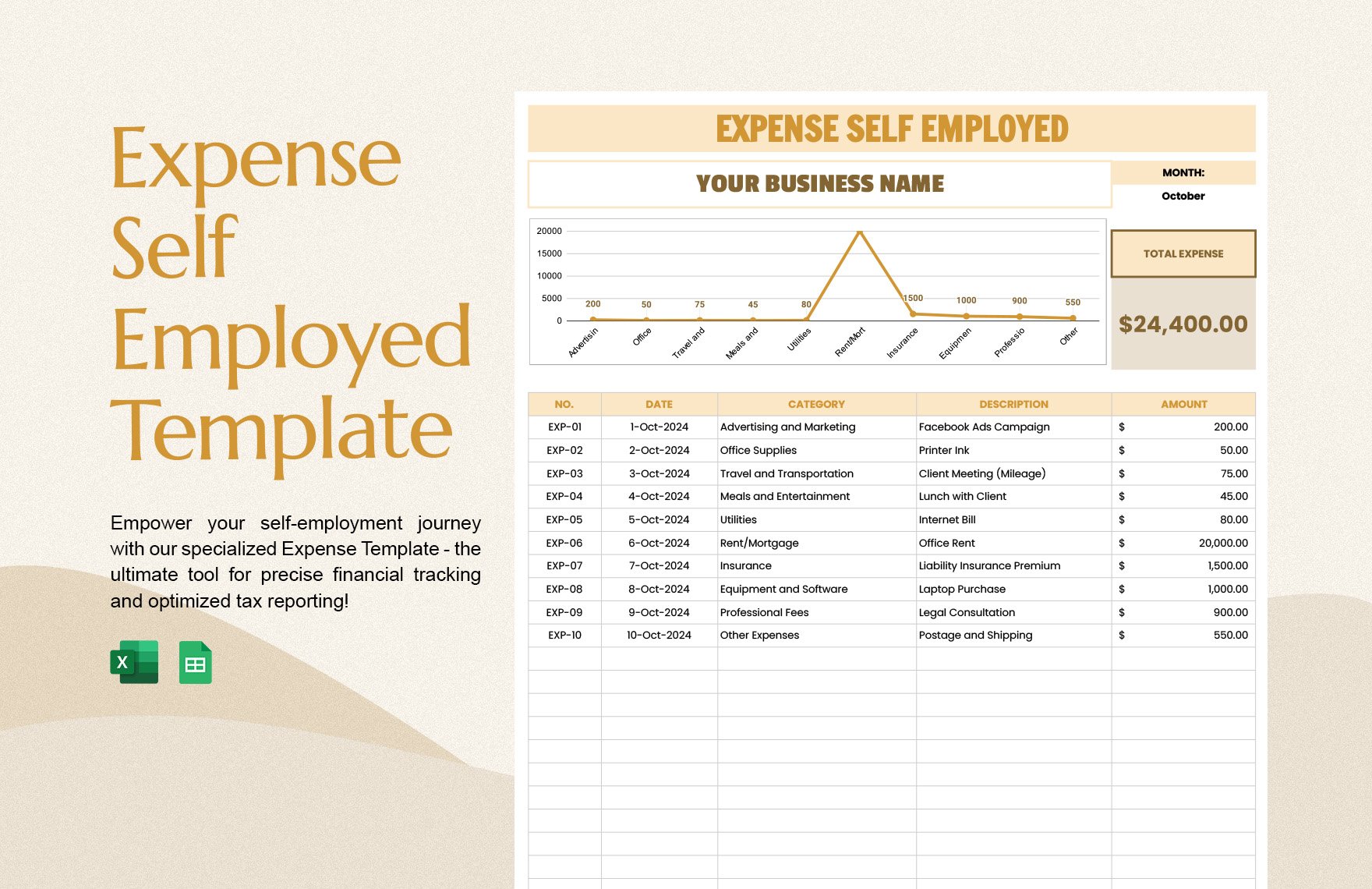

Source : www.amazon.comExpense Self Employed Template in Excel, Google Sheets Download

Source : www.template.netAmazon.com: tax year diary 2024 2025: A5 Financial year diary week

Source : www.amazon.comTAX ASSISTANCE | United Way of Pierce County

Source : www.uwpc.orgBusiness Expenses For Self Employed 2024 Amazon.com: Tax Year Diary 2024 2025: Income and Expenses Tracker : Because I’m self-employed, I have to think carefully about my income so I’m ready for tax season, but the looming deadline isn’t a worry for me. . One of the most common methods for tracking vehicle expenses is maintaining a mileage log. This log keeps a record of the distance you travel for business purposes. Self-employed professionals can .

]]>