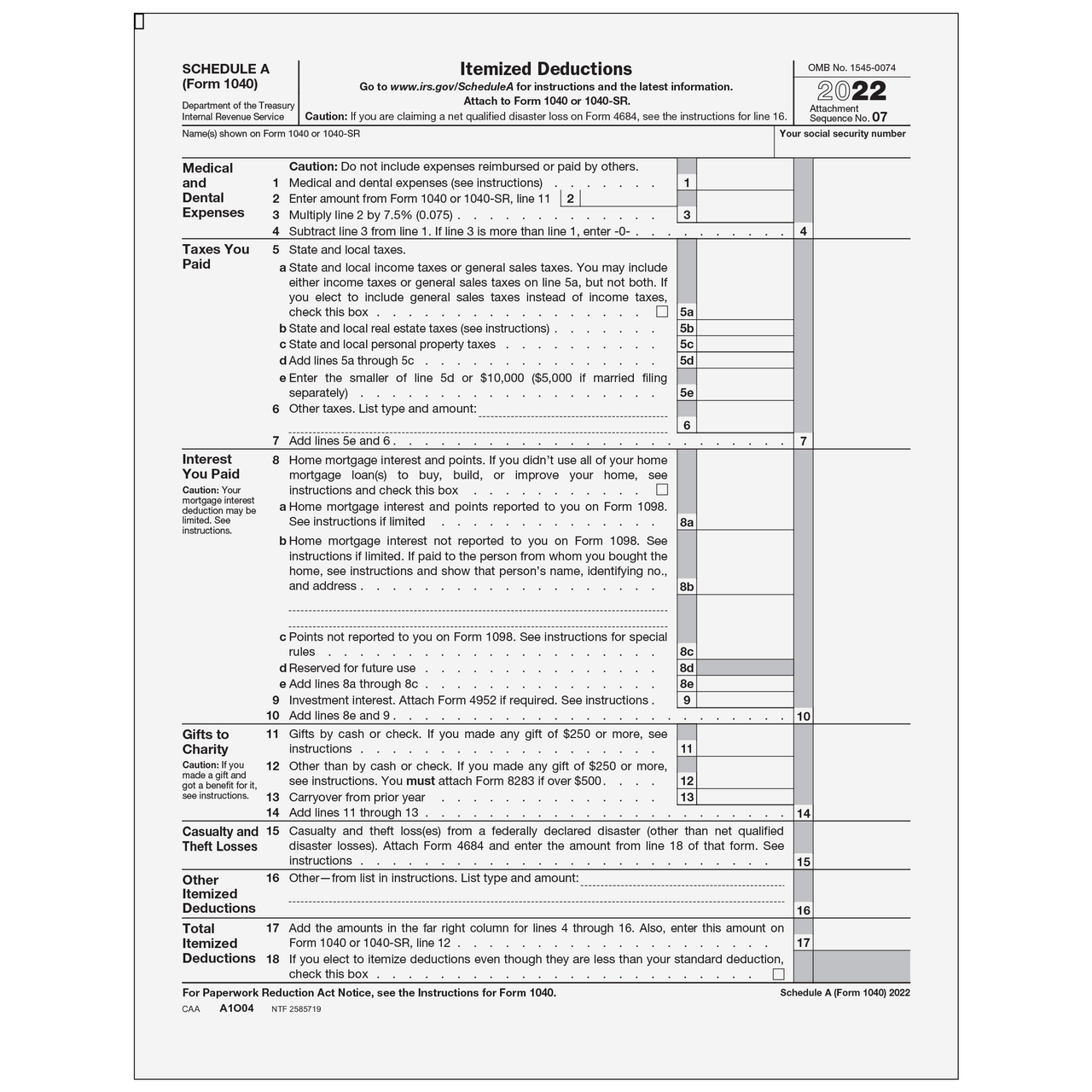

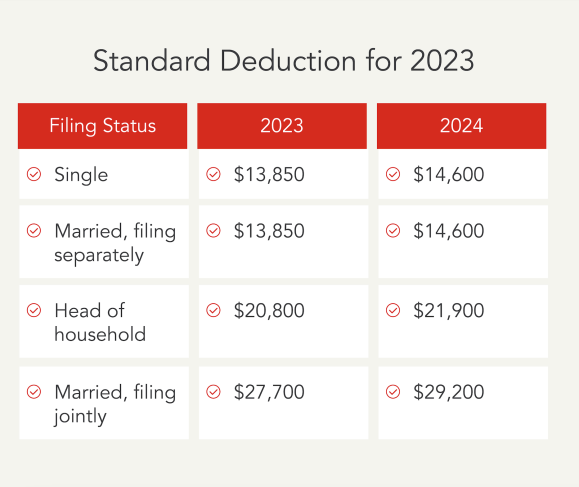

Schedule A Itemized Deductions 2024 – For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. . To claim your itemized deductions, fill out Schedule A of the Form 1040. Each line on the schedule describes a specific type of allowable expense that can be itemized. How to calculate itemized .

Schedule A Itemized Deductions 2024

Source : www.investopedia.comWho Should Itemize Deductions Under New Tax Plan | SmartAsset

Source : smartasset.comWhat happened to Schedule C? (Q Mac) — Quicken

Source : community.quicken.comA1O04 Form 1040 Schedule A Itemized Deductions Greatland.com

Source : www.greatland.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

Source : www.nslawservices.orgIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comSchedule a Itemized Deductions 2022 2024 Form Fill Out and Sign

Source : www.signnow.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comSchedule A (Form 1040) Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comStandard vs. Itemized Deduction Calculator: Which Should You Take

Source : blog.turbotax.intuit.comSchedule A Itemized Deductions 2024 All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: An overwhelming majority of American taxpayers—about 90%—claim the standard deduction on their federal income tax return. And, for most of those people, the standard deduction is the largest tax . To claim your itemized deductions, you need to complete Schedule A, Itemized Deductions, of the Form 1040. That total is written on Line 12 of the Form 1040—the same line where the standard deduction .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)